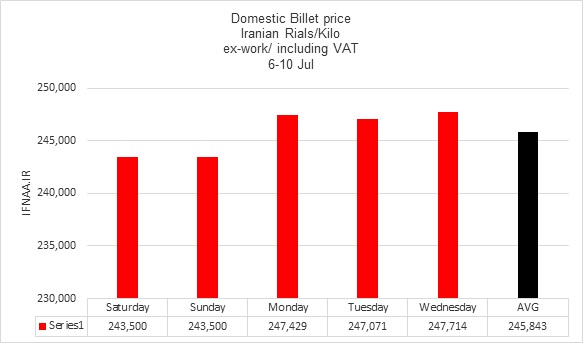

Billet: Billet price rose during last week in Iran domestic market due to its limited supply level.

Long Products

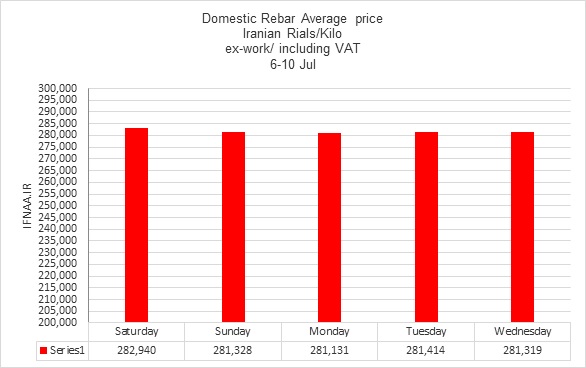

Rebar: The problem of demand and, on the other side production issues, led to the stability and stagnation of rebar market.

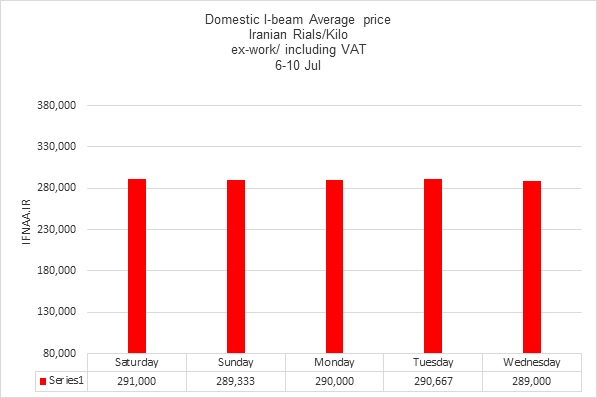

I-beam: Low demand caused I-beam price to decrease.

Flat Products

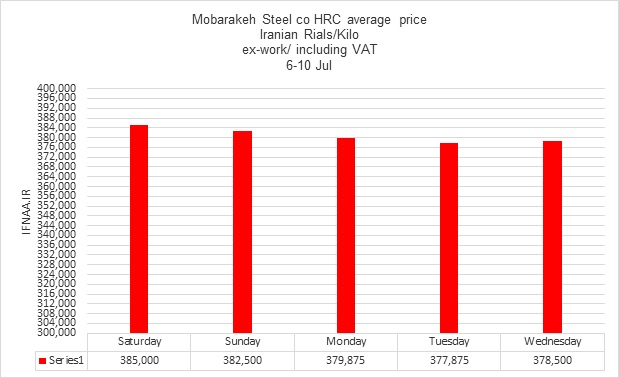

HRC: low demand and supply of products from different mills and imported cargoes reduced HRC average price.

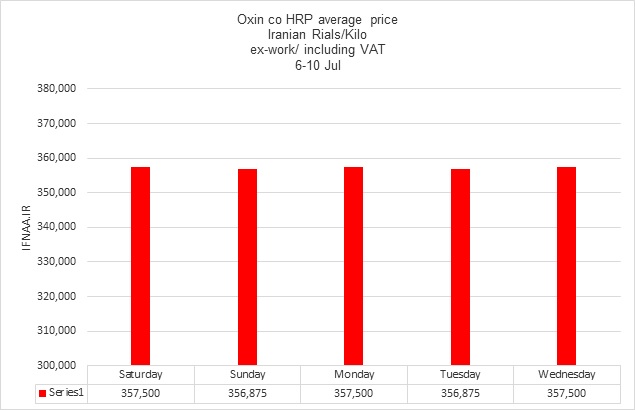

HRP: Balanced supply- demand made Oxin co HRP market stable.

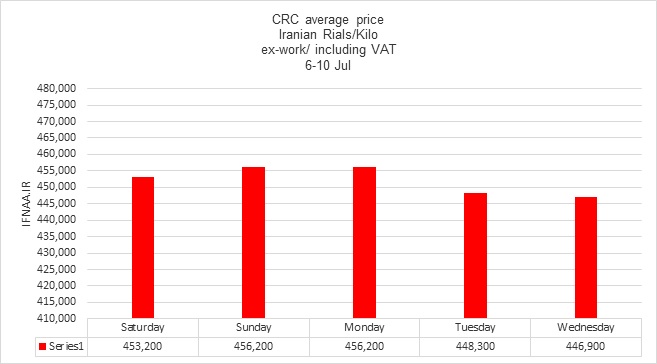

CRC: Lower demand and supply of imported products caused CRC price to decrease.

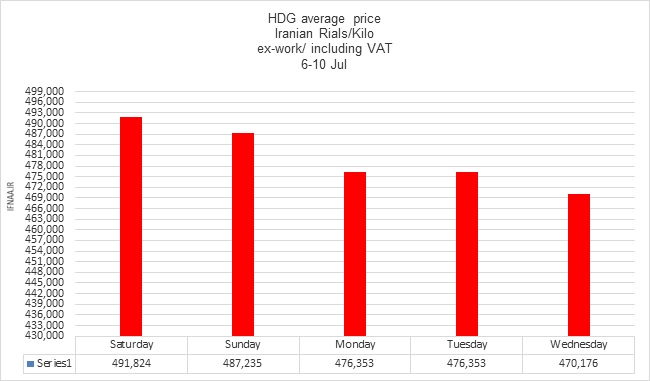

HDG: The drop in the price of HRC and CRC caused a decrease in the price of HDG.

Weekly Analysis:

In the world market:

The global market has remained almost constant. Despite some rise of iron ore, billet price didn’t improve, China's export statistics also show that the country's export level have increased. In fact, China has solved the problem of its steel sector by increasing export. The issue of Gaza has remained unsolved, while holidays in Western countries have reached their peak, which lowers consumption. Even though oil price has crossed USD 80/ barrel, its impact has not yet been transferred to steel market.

In the domestic market:

The heat has increased power consumption. In addition, the mourning ceremonies of Muharram has greatly increased the electricity consumption. As a result, the government started shutting down the provinces on Wednesday, and by Thursday, close to 12 provinces were declared closed. For this reason, the consumption of steel, especially flat products, has reached its minimum. Meanwhile, the imported sheets have put pressure on the domestic production.

Even though Mobarakeh steel co has stopped supply of its HRC this month, but due to the sharp decrease in demand, its price trend is downward. As for long products, limited supply of billet seriously bothers the production.

It has reached a point where one billet producer announced to IME ( Iran Mercantile Exchange) that due to the power cuts, it is not possible to deliver the goods sold at IME. Billet shortage has affected rebar producers and consequently its demand has decrease drastically.

In the current situation, small mills are severely lacking liquidity, and some large mills have surplus inventory, especially in DRI sector.

This outlook does not seem to change in August. Product demand will remain low unless the new government revises its policies, especially in the export and exchange rate sectors.

CBI average ex-rate for Steel Products (SANA): Rials 431,144 / 1USD

14 July 2024

M.Chitsaz

Iran Steel News Bulletin

IFNAA.IR

IRSTEEL.COM