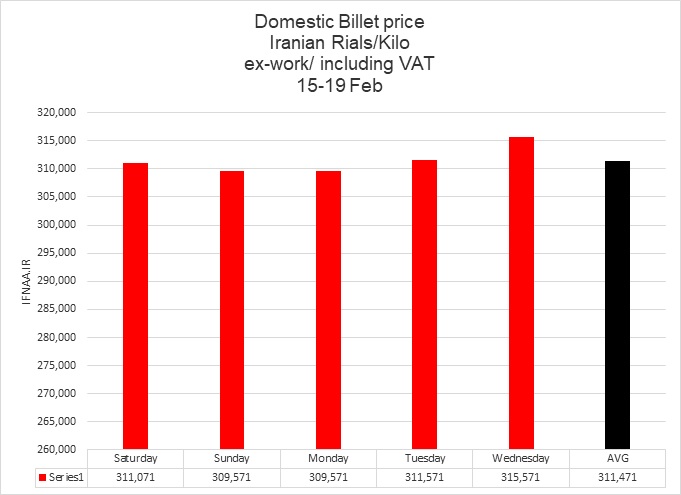

Billet: Billet price Increased due to supply management

and higher exchange rate.

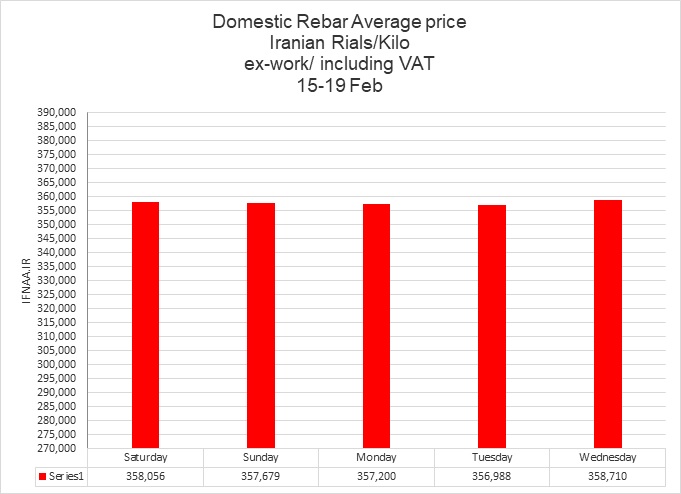

Long Products

Rebar: A decrease in supply on the stock exchange

and a rise in ex-rate caused rebar price to climb.

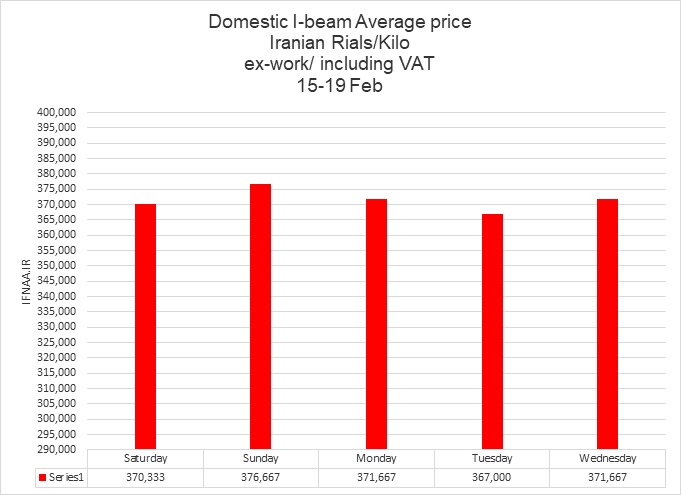

I-beam: Stable supply-demand level made I-beam

market stagnant, but higher ex- rate at the end of the week caused prices to

rise and return to the beginning of the week rates.

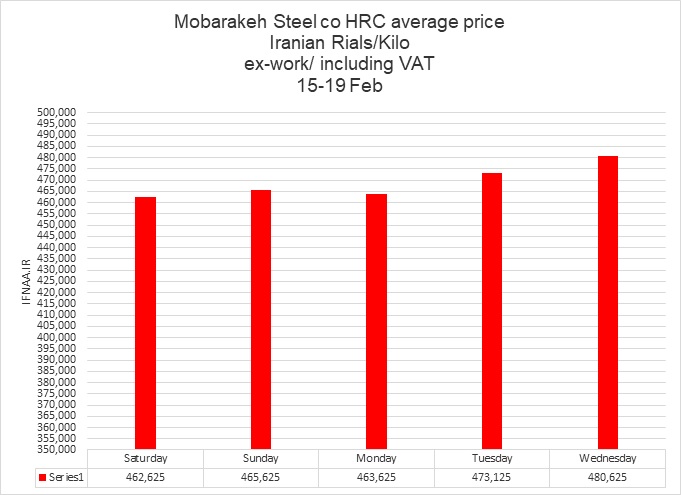

Flat Products

HRC: Supply management, aided by fluctuations in currency

rate, drove up price of HRC.

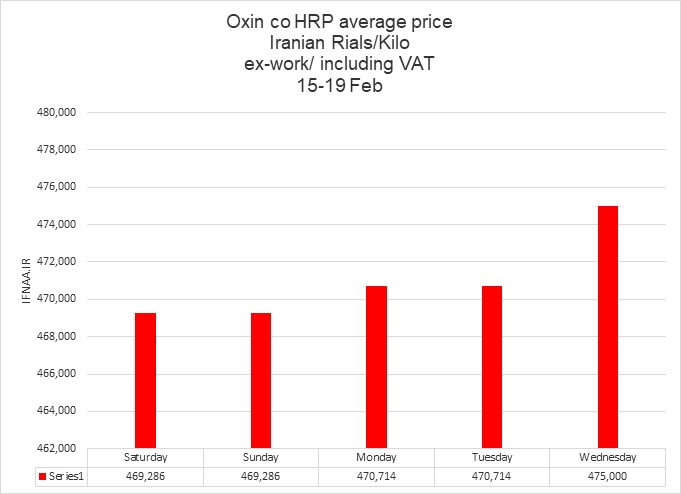

HRP:

A reduction in supply, coupled with a rise in slab price, led to an increase in

Oxin co HRP price.

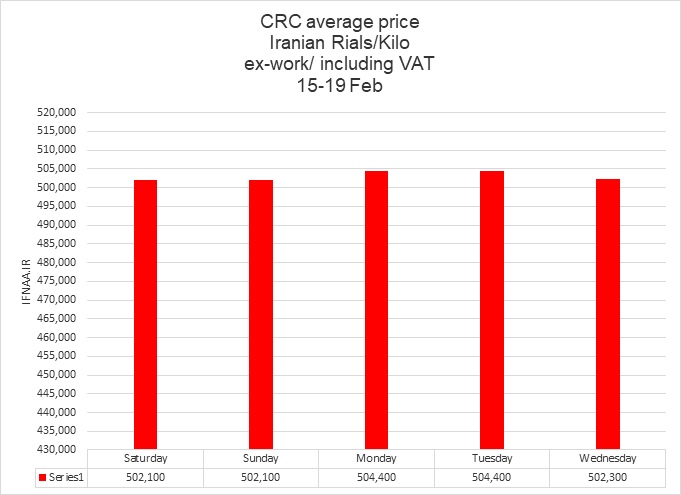

CRC: The balance of supply and demand kept CRC

market stable.

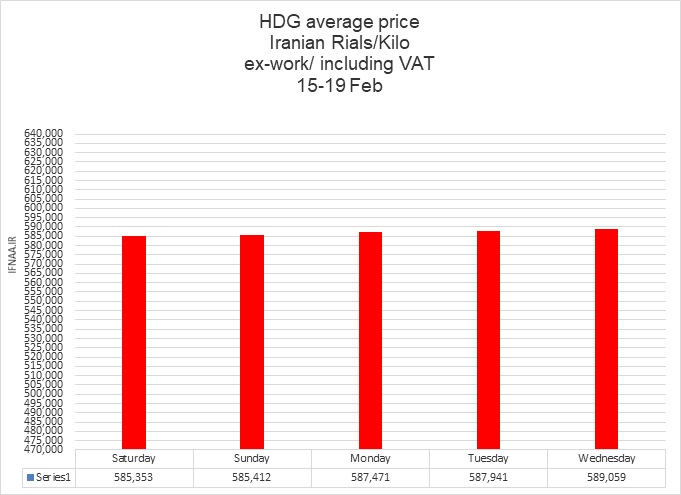

HDG: The rise in the exchange rate and HRC price

could not affect HDG market. Zinc price in global markets is declining, and

this affects prices in a context of weak demand.

Weekly Analysis:

In

the world market: The global market is quiet. Scrap price have

risen in the US due to tariffs, and in Turkey due to demand, but have not

changed globally. Billet price has remained stable with weak demand. Flat

products have remained stable, and the European market remained stagnant. In

the past week, Israel began clearing Gaza. Arab countries are gathering in

Saudi Arabia, with the main issue of discussion being the future of Gaza and

its reconstruction. Turkey has begun construction in Syria, and the Iraqi

government has granted permission for the export of Kurdistan oil.

Collection

of all regional economic news indicates an active summer, but Trump's policies

have disrupted everything, preventing long-term planning. Currently, three

issues are affecting the future of world economy: Ukraine, Iran, and investment

potential on the wealth of the Persian Gulf states.

In

the domestic market: The commodity exchange and steel companies are

trying to make up for last nine-month lag. Some companies have reduced supply

level and are allocating a larger percentage of deliveries for next year. Base

price of rebar in the coming days will reach Rials 340,000 /Kilo, meaning a

final price above Rials 370,000. Therefore, billet, according to the stock

exchange formula, should reach a final price of Rials 320,000.

With

the events that are coming, any price drop will not last long. The parliament

has increased next year's taxes while investment, economic growth, and other

economic indicators do not show that achieving this tax level is possible.

Perhaps the government's hope is in the exchange rate.

In

any case, the steel market should expect new price levels, and a return to the

prices of a month ago is not possible due to rising costs. Two months ago,

there was talk of a Rials 350,000 rebar outlook, but today the talk is of Rials

380,000- 400,000.

CBI

average ex-rate for Steel Products (SANA): Rials 671,876/ 1USD

24 Feb 2025

M.Chitsaz

Iran Steel News Bulletin

IFNAA.IR

IRSTEEL.COM